UDOW presents a cutting-edge approach to enhance your Dow Jones Industrial Average exposure. By leveraging advanced techniques, UDOW empowers investors to seize amplified returns from the fluctuating Dow market. With its unique structure, UDOW offers a compelling solution for those seeking to elevate their portfolio results.

- Unlocking Amplified Dow Returns with UDOW

- Harness UDOW's knowledge

- Strengthen your investment portfolio

UDOW's open structure provides investors with clarity into the underlying mechanisms driving its methodology. Whether you are a seasoned investor or just starting your investment journey, UDOW click here offers a valuable opportunity to increase your exposure to the Dow Jones Industrial Average.

The ProShares UltraPro Dow30 ETF (UDOW): Exploring 3x Leverage

The ProShares UltraPro Dow30 ETF (UDOW) is a novel investment tool that offers investors exposure to the Dow Jones Industrial Average with enhanced returns. This exchange-traded fund (ETF) utilizes multiplication to achieve its stated goal of delivering three times the daily yield of the Dow Jones Industrial Average. However, investors should meticulously understand the potential downsides associated with this type of financial product. UDOW's high risk makes it a appropriate option for experienced traders who are comfortable with significant fluctuations in their portfolios.

- Prior to engaging with UDOW, it's essential to conduct your own due diligence and seek advice from a qualified financial professional.

- Understanding the principles of 3x leverage, as well as its potential benefits, is essential for making sound judgments about your investments.

Moreover, UDOW's results may not always precisely correlate with the Dow Jones Industrial Average. Various factors|Multiple variables|Numerous elements can influence ETF performance, including market conditions.

Harnessing the Dow's Volatility: Strategies for UDOW Investors

Investing in inverse ETFs like UDOW can be a intriguing proposition, particularly during periods of dramatic market movements. While these funds offer the potential to profit from downturns in the Dow Jones Industrial Average, it's crucial to engage volatility with a well-defined strategy. Consider utilizing hedging techniques such as stop-loss orders to mitigate potential losses. Furthermore, asset allocation across diverse asset classes can help insulate your portfolio from the consequences of any specific market sector's performance. Remember that UDOW investments are best suited for seasoned investors who fully understand the risks involved.

- Perform thorough research on the fund's basis

- Observe market trends and economic data

- Remain current on news and events that might affect the Dow Jones Average

Should You Include UDOW in Your Portfolio?

Deciding whether to include UDOW into your portfolio is a decision that demands careful evaluation. UDOW, with its distinctive investment approach, presents both anticipated rewards and inherent risks. A thorough grasp of UDOW's mechanics is essential before investing your capital. It's crucial to determine your risk capacity and investment aspirations to see if UDOW matches with your overall financial plan.

- To begin, research UDOW's past performance. Past results don't guarantee future profits, but they can offer valuable clues.

- Next the uncertainty inherent in UDOW investments. Are you comfortable with the potential for considerable price swings?

- Finally, discuss a qualified financial expert. They can provide personalized guidance based on your individual circumstances.

Delving into UDOW: Your Guide to Leveraged Dow Exposure

Gaining exposure in the Dow Jones Industrial Average (DJIA) can be a strategic move for investors seeking growth. However, traditional DJIA ETFs might not always offer the level of boost desired. This is where UDOW, a multiplier ETF tracking the DJIA, comes into play.

UDOW provides traders with an avenue for amplifying their exposure to the Dow Jones' performance. It operates on a 2x leverage ratio, meaning that for every 1% fluctuation in the DJIA, UDOW aims to display a 2% alteration.

Understanding the mechanics of UDOW is vital before engaging. It's not simply a traditional ETF, and its leveraged nature exposes both opportunities that require careful consideration.

The UDOW ETF's Turbulent Ride: A Guide for Savvy Investors

The UDOW ETF has emerged as a thriving investment option within the risky landscape of modern finance. Its niche portfolio, focused on cutting-edge technologies, attracts investors seeking rapid growth. However, this high-octane nature presents headwinds that require diligence.

Understanding the fluctuations within the UDOW ETF's trajectory is crucial for traders. Analyzing sector-specific trends can help minimize risk while maximizing investment growth.

Rider Strong Then & Now!

Rider Strong Then & Now! Andrew Keegan Then & Now!

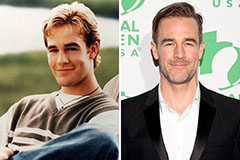

Andrew Keegan Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Heather Locklear Then & Now!

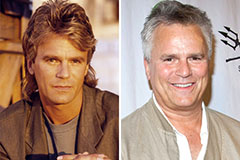

Heather Locklear Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!